Discover how this Slovenian bank uses a Wacom solution to ensure its contracting processes are legally binding.

Financial Services

Big financial decisions

Powered by Wacom

Financial Services providers use Wacom solutions to help secure legally-binding agreements from customers for everything from account opening, to credit agreements.

Supporting significant commitments

Modern banks, insurance firms and other financial service providers need to put customers at ease when making important commitments such as mortgages, credit agreements, and loans.

But they also need to streamline their processes and eliminate paper-based workflows to accelerate revenue generation and minimize customer wait times, while ensuring signature authenticity.

How Wacom helps

Wacom solutions for financial services enable financial service providers to achieve these objectives in a number of ways. Firstly, document management becomes faster and more efficient through the instant digitization of forms, which also reduces paper waste and the costs of managing it.

Secondly, Wacom digital pen and ink technologies ensure a familiar handwritten signing and form-processing experience for financial services professionals and their customers. And the experience is improved thanks to the elimination of clumsy keyboard and mouse inputs that interrupt in-person interactions.

Financial Services Use Cases

Account Opening

Powered by Wacom

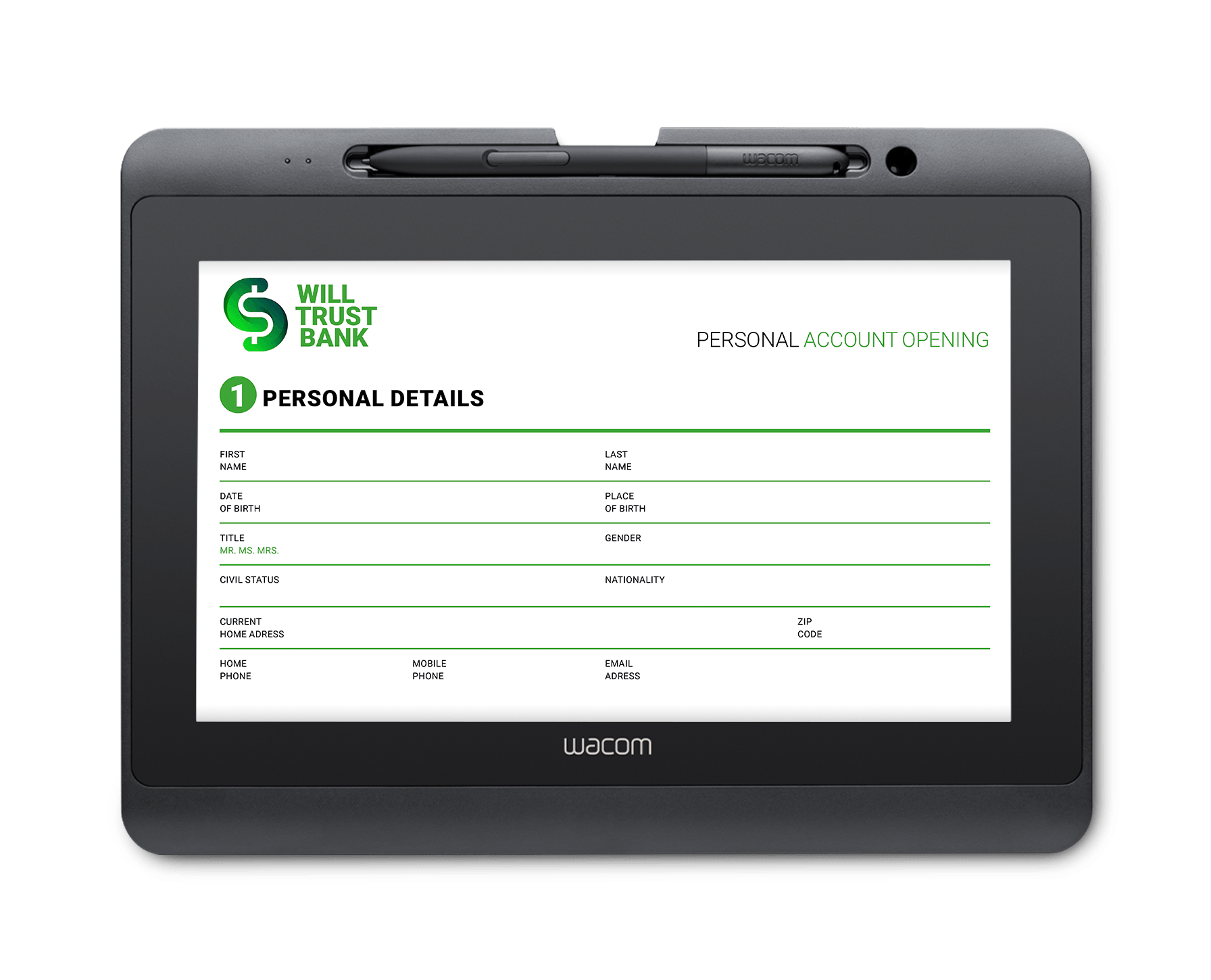

Today’s customers expect a quick, easy account opening or sign up experience. Wacom solutions help financial service providers deliver it.

-

Overview

-

Enable efficient branch modernization

Financial services providers want to streamline their processes. But they also want to retain the human touch that customers value when making important financial decisions at the bank counter. Wacom solutions enable this by:

- Accurately replicating traditional pen and paper signatures, with the added benefit of a completely digital process.

- Saving time and paper costs by eliminating the need to print, scan, and retrieve paper.

- Freeing bank tellers to focus on serving customers optimally.

Verification

Powered by Wacom

Signatures are still the most familiar way to make big financial commitments - but they need to be secure. Wacom solutions can help.

-

Overview

-

Preventing and identifying signature fraud

Financial services firms need to ensure customer agreements are legally binding, prevent imposters from attempting to commit fraud, and identify signature anomalies after the fact. So, how do you recognize someone trying to forge or disguise a signature in real time, or spot fake signatures amongst genuine ones?

Wacom Ink SDK for verification helps bank clerks confirm the identity of customers in real time. It also supports anti-fraud teams spot signature anomalies over time during their investigations.

Specifically, the SDK:

- Compares new or suspicious handwritten signatures with known genuine examples in real-time or as part of a forensic examination process.

- Provides an immediate acceptance or rejection notification.

- Is the most accurate, secure and cost-effective solution available.

- Does not store any signature data, eliminating compliance concerns.

“This solution has been extremely well received by users.”

Mrs Damjanovičeva, Executive Director, Retail banking and Micro-enterprises

Insurance Contracting

Powered by Wacom

Insurance is a complex business, but customers want simplicity. Wacom solutions help make the process of securing coverage easier and more comfortable.

-

Overview

-

Case Study

-

Accelerate Insurance Contract Management

When signatures are required for insurance contracts, Wacom solutions for financial services enable providers to:

- Utilize a Wacom signature pad connected to a laptop computer to replace slow and time-consuming processing of paper documents.

- Empower agents to share policy information with the customer on their screen and guide the customer through the contract process.

- Provide a more immersive and intuitive experience, especially when completing digital contract forms, via electronic signatures entered directly on the screen, as on paper.

- Give policyholders a clear view of the full document that they can annotate and sign using digital ink.

Pre-insurance documents

Powered by Wacom

Insurance is a complex business, but customers want simplicity. Wacom solutions help make the process of securing coverage easier and more comfortable.

-

Overview

-

Streamline the insurance on-boarding process.

Technology should never get in the way of important in-person interactions such as arranging insurance coverage. Wacom solutions for insurance providers avoid this by:

- Empowering agents to share policy information with the customer on their computer screen and guide the customer through the application, approval, or claims process.

- Providing an electronic signature box, displayed on a Wacom signature pad or pen display, to allow the customer to sign amendments or requested changes to coverage directly on the screen, just as they would on paper.

- Enabling familiar yet digitally efficient interactions that maximize customer satisfaction.