Information Disclosure Based on the TCFD Recommendations

1. Purpose

Wacom recognizes climate change as an important consideration in striving to enhance sustainable corporate value and contribute to the realization of a sustainable society. We expressed our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) on April 13, 2023. Based on the TCFD recommendations, we will promote information disclosure on governance, strategy, risk management, and metrics and targets, and continue to enrich content related to sustainability.

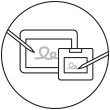

2. Governance

Wacom has established an ESG Task Force to ensure that the Board of Directors appropriately supervises and advises on important issues related to sustainability, such as climate change. The ESG Task Force meets regularly to examine specific sustainability policies and consider strategies, measures, and progress toward environmental targets. Participants include the President and CEO, the CFO, the environmental management representative, the secretariat of the Compliance and Risk Committee, and IR staff. Of the matters discussed by the ESG Task Force, important subjects—particularly those related to management risks and opportunities—are reported annually to the Board of Directors, which includes outside directors.

3.Strategy

Through the ESG Task Force, Wacom collects data and parameters necessary to identify and assess climate change-related risks and opportunities and analyzes the degree of business impact.

In considering and analyzing the degree of impact and potential countermeasures, we utilize scenarios published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and analyze the impact based on two different scenarios for the year 2030.